Community Management Solutions Election 2024

Community Management Solutions is an organisation registered under the Fair Work (Registered Organisations) Act 2009. Under it’s Rules elections are held usually every 3 years. The election process is conducted on behalf of the Registered Organisations Commission by the Australian Electoral Commission (AEC) in accordance with the above Act. All financial Members as at 31st […]

Part Time Teacher – Yeronga Park Kindergarten

About the Role: A rare opportunity has become available for an experiences Early Childhood Professional to join the team at our Community Kindergarten. Our two-unit Kindy provides a programme for four groups of children attending either a 2-day or 3-day a week programme. We are proud of our beautiful natural environment and extensive indoor and […]

CMSolutions is Closed for the EKKA

Breaking News – Vaccine Mandate Withdrawn

Vaccine Mandate information HERE

Link Up – Sorry Day Breakfast

Link-Up Qld Sorry Day Breakfast 2022

Term Time and Public Holidays

We are currently in a purple patch of public holidays (try to say that three times fast) which is causing some confusion for P&C’s and their “Term Time” employees. Our advice is as follows. Term Time employees are engaged to work during term periods only and therefore any period of school holidays, or other period […]

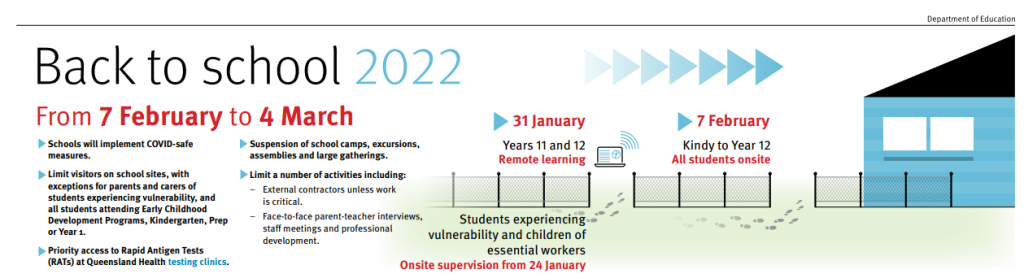

Back to School 2022

Download the back to school plan below back-to-school-plan

Community Management Solutions Scheduled Election 2024

Community Management Solutions is an organisation registered under the Fair Work (Registered Organisations) Act 2009. Under it’s Rules elections are held usually every 3 years. The election process is conducted on behalf of the Registered Organisations Commission by the Australian Electoral Commission (AEC) in accordance with the above Act. All financial Members as at 31st […]

Federal Employers – Casual Conversion

Casual Conversion – Federal Employer only **Does not apply to P&Cs** All large employers (those that employ 15 or more staff) are required to communicate with casual employees every 12 months to advise whether or not they are offering to convert that employee to full time, or part time employment. Section 66B of the Fair […]

EKKA SHOW PUBLIC HOLIDAY POSTPONED

The State Government has announced that it will postpone the EKKA Show Public Holiday for the Brisbane City and Scenic Rim regions. Therefore, the scheduled public holidays for 11 August (Brisbane City) and 9 August (Scenic Rim) will be cancelled and listed for another day later in the year. All services may operate as usual […]